Frequently Asked Questions about Offshore Company Formation

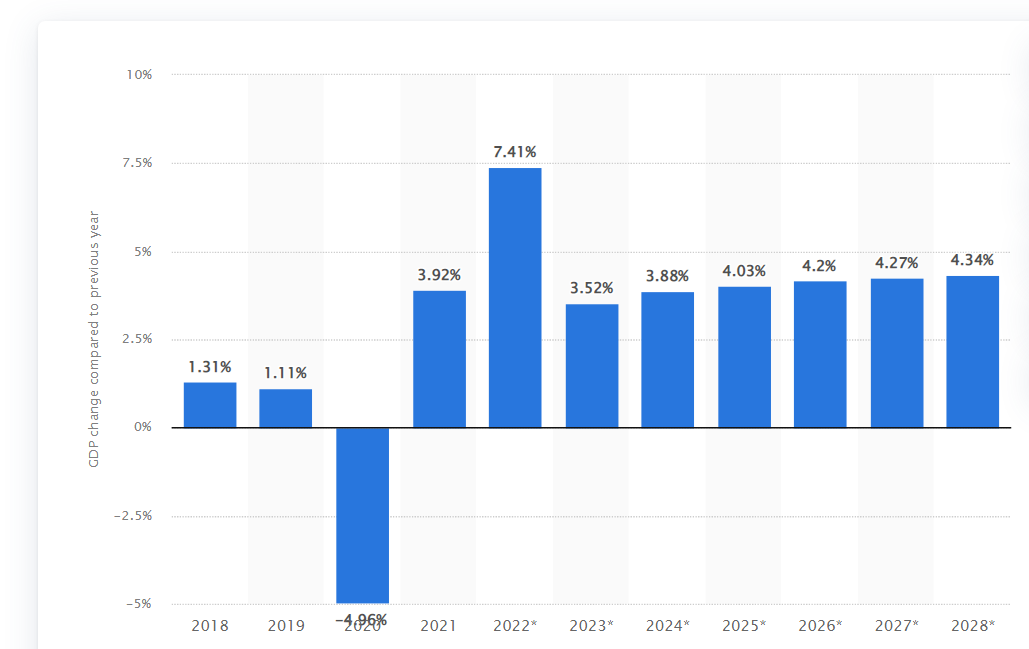

After the dry spell during the pandemic years, UAE’s GDP is showing positive signs of growth. According to Statista, by 2028, the region’s GDP will increase by 4.34%. No wonder so many entrepreneurs from all over the world are so eager to either start a new venture or expand their operations in Dubai, Abu Dhabi, RAK, Ajman, and other states of the Emirate.

Source: https://www.statista.com/statistics/297772/uae-gross-domestic-product-change-percent/

Are you thinking along similar lines? Do you have plans for offshore company formation in the UAE? Then let’s get your queries answered through this blog. It will guide entrepreneurs, trying to navigate past the legalities and compliances of setting up an offshore company in the region.

1. Why choose UAE to set up an offshore company?

We are starting by answering the standard question, why is UAE, out of so many other nations? At the beginning of this blog, we have already mentioned that the region is poised for steady growth in the coming years. So, you can rest assured about economic stability. Another reason is the geographical advantage. The UAE gives you easy access to markets in Europe, Asia, and Africa. Zero capital repatriation and lenient regulatory compliances are other advantages. The governments are welcoming foreign entrepreneurs planning to invest in the region.

2. What are the jurisdictions for forming an offshore company in the UAE?

Offshore company formation in the UAE requires three jurisdictions:

- RAK ICC

- Ajman

- JAFZA

For Dubai, there is single offshore jurisdiction in Jebel Ali Free Zone. It is called the JAFZA offshore.

3. How much share capital do you need for offshore company formation in the UAE?

There is no standard share capital stated by the authorities. However, 1000 shares with 10 Dhs share value are acceptable in the UAE. It has to be either in Arab Emirates Dirhams or US Dollars.

4. What activities can be done through offshore companies?

- To own real estate

- Holding companies

- General trading

- As a medium for inheritance issues

5. Where does one declare the offshore company objects?

You need to declare the activities concerning the offshore company in the application form during registration.

6. How much time does it take for an offshore company in UAE?

If you have all the papers in order and with help from a reliable consultant you can set up the offshore company within 2 days.

7. What should be the age of the company director?

The company director should be at least 21 years of age to set up an offshore account.

8. Can a person be a shareholder in multiple offshore companies?

One person can be a shareholder in multiple offshore companies. Even an offshore company can be a shareholder in a UAE offshore company.

9. Can the company owner protect his assets through the offshore company?

As a company owner or director, you can protect your assets through the offshore company. It is one of the prominent reasons why so many people are interested in opening such an enterprise in the UAE.

Wrapping Up

Hopefully, we were able to answer your queries about offshore company formation in the UAE. For more information and assistance to start your enterprise in the region, feel free to contact an experienced consultant.